Catalog excerpts

Stanley Black & Decker Third Quarter 2016 Overview October 27, 2016

Open the catalog to page 1

/ f/t//f////f/f //f/ft/n/f /f/tf/f////f ////f/tz/f/tf/f /tt/f/ft/f/f t/f/f//f ///// /ft//////////// /tf/f//f////t(/f////t(/f ////ft/ Greg Waybright VP, Investor & Government Relations

Open the catalog to page 2

Cautionary Statements Certain Statements Contained In This Presentation Are Forward Looking. These Are Based On Assumptions Of Future Events Which May Not Prove To Be Accurate. They Involve Risk And Uncertainty. Actual Results May Differ Materially From Those Expected Or Implied. We Direct You To The Cautionary Statements Detailed In The Corresponding Press Release And Form 8-K And Our

Open the catalog to page 3

3Q 2016 Highlights Achieved Solid Organic Growth & Margin Expansion Amid Challenging Conditions… • Organic Growth Of 3% | Total Growth Of 2% • Robust Organic Growth In Tools & Storage (+5%) Led By Europe (+11%) • Security Up (+2%) With All Regions Contributing | First Quarter Of Organic Growth In NA Since 2Q’15 • Industrial Organic Decline (-4%) Due To Lower Engineered Fastening Electronics & Industrial Volumes • Operating Margin Rate Expands 40 Bps To 15.2% As Strong Operating Performance More Than Offset Currency Headwinds & Growth Investments • Diluted EPS Of $1.68 Up 8% Versus Prior...

Open the catalog to page 4

Acquisition Of Newell Tools Transaction Recap • Announced Agreement To Purchase Tools Business • Complementary Fit To Existing Tools Business With Strong, Long-Term Revenue Synergy Opportunities • Acquisition Consistent With Strategic Growth • Three-Year, Self-Imposed BD Moratorium Lifted Upon Strengthened Core Business Foundation • EPS Accretion, Ex-Charges, Of ~$0.15 Per Share Expected In Year One And ~$0.50 Per Share In Year Three • Transaction Expected To Close In First Half Of 2017 Product & Regional Sales Mix Newell Tools Is A Highly Attractive Asset With Strong Brands, Complementary...

Open the catalog to page 5

3Q 2016 Segment Overview Tools & Storage $1,838 • +5% Organic Growth • +4% NA, +11% EUR, ~Flat EM • +8% PT, -3% HTS • +2% Organic Growth • +2% NA/EM • +1% EUR • -4% Organic Growth • -6% Engineered Fastening • +5% Infrastructure • NA: Share Gains Fueled By Strong Commercial Execution & New Product Launches, Including FLEXVOLT • EUR: Share Gains Continued Across Most Regions • EM: Middle East Weakness Offset Growth in LA & Asia • NA: Growth Led By Higher Commercial Electronic Security & Automatic Doors Volumes • EUR: Growth Driven By Higher Install Volume • Double – Digit Gains In Emerging...

Open the catalog to page 6

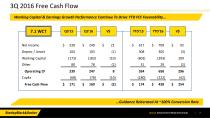

3Q 2016 Free Cash Flow Working Capital & Earnings Growth Performance Continue To Drive YTD FCF Favorability… Deprec / Amort Working Capital Other Operating CF CapEx Free Cash Flow …Guidance Reiterated At ~100% Conversion Rate 3Q'16 INVESTOR PRESENTATION

Open the catalog to page 7

2016 Outlook Raising Mid-Point And Tightening 2016 EPS Outlook To $6.40 - $6.50 From $6.30 - $6.50 Maintaining Free Cash Flow Conversion Of Approximately 100% Of Net Income FY2016 Guidance Item 2016 EPS & FCF Guidance • 2016 EPS (GAAP) • Free Cash Flow FY2016 Segment Outlook Org Rev Growth Margin Rate Key Assumption Change: Improved Operational Performance (I.E. Cost, Productivity), Primarily Within Tools & Storage Guidance Excludes Potential 4Q’16 Acquisition Costs Tools & Storage High Single Digit Mid Single Digit Decline Targeting 8-10% EPS Growth Despite Another Year Of Significant...

Open the catalog to page 8

2016 Momentum Continues With Solid 3Q Performance... Strong 3Q Organic Growth Of +3% & EPS Performance (Up 8% VPY To $1.68) Raising Mid-Point Of And Tightening Guidance Range To $6.40 - $6.50 From $6.30 - $6.50 Successful Launch Of DEWALT FLEXVOLT™ Battery System Announced $1.95B Acquisition Of Newell Tools On October 12, 2016 Expect Security Update In 4Q'16 , Well Positioned To Achieve Updated Financial Commitments

Open the catalog to page 9

Global Presence Canada

Open the catalog to page 11

Regional Revenue Breakout 3Q 2016 Emerging Other

Open the catalog to page 12

These results reflect the Company’s continuing operations. In 4Q’14, the Company classified the results of the Security segment’s Spain and Italy operations as held for sale based on management’s intention to sell these operations. In July 2015, the Company completed the sale of these operations. The operating results of Security Spain and Italy have been reported as discontinued operations for 3Q’15 through the date of the sale. Total sales reported as discontinued operations were $3.9 million for 3Q’15. Organic sales growth is defined as total sales growth less the sales of companies...

Open the catalog to page 13All Stanley Tools catalogs and technical brochures

-

Investor Materials

62 Pages

-

SWK

156 Pages

-

Storage

20 Pages

-

Hammers

12 Pages

-

Saws

16 Pages

-

Measuring Tools

10 Pages

-

2011 Hand Tools Catalog

212 Pages