Catalog excerpts

Cautionary Statements This presentation contains “forward-looking statements,” that is, statements that address future, not past events. In this context, forward-looking statements often address our expected future business and financial performance and financial condition, and often contain words such as: “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” or “will.” Forwardlooking statements by their nature address matters that are, to different degrees, uncertain. These statements are based on assumptions of future events that may not prove accurate. They are also based on our...

Open the catalog to page 2

Tools & Storage Emerging Markets Stanley Fulfillment System 2.0 Greg Waybright Vice President, Investor & Government Relations Michelle Hards Director, Investor & Government Relations Analyst, Investor & Government Relations

Open the catalog to page 3

A Diversified Global Leader STANLEY BLACK & DECKER (NYSE: SWK) 2015 Revenue: ~$11.2B Cash Dividend Yield: 2.0% Dividend Paid Consecutively For 140 Years; Increased For Past 49 Consecutive Years Security $2.1B • Convergent Security • Mechanical Access Security Industrial Tools & Storage • Power Tools & Accessories • Hand Tools & Storage • STANLEY Engineered Fastening • Infrastructure Building World Class Branded Franchises With Sustainable Strategic Characteristics That Create Shareholder Value Market Cap & Dividend Yield Are As Of Market Close 10/26/2016 $116.77

Open the catalog to page 4

Strategic Framework Continue Organic Growth Momentum • Mix Into Higher Growth, Higher Margin Businesses • Increase Relative Weighting Of Emerging Markets (Goal = 20%+) Be Selective And Operate In Markets Where: • Value Proposition Is Definable And Sustainable Through Innovation • Global Cost Leadership Is Achievable Pursue Acquisitive Growth • Consolidate Tool Industry And Strengthen The Core • Expand Industrial Platform (Engineered Fastening | Infrastructure) Key Themes: Growth And Margin Expansion Accelerated Via Stanley Fulfillment System

Open the catalog to page 5

Global Franchises – Long Term Value Drivers A Company That Has Built Well Established, Global Franchises… Business Value Drivers • Brands • Innovation • Global Scale • Highly Engineered, Value Added Innovative Solutions • Recurring Revenue Model • Global Scale High Profitability; GDP+ Growth In Commercial Electronic Security Potential Large Margin Accretion Opportunity Longer Term Power & Hand Tools Construction, DIY, Auto Repair & Industrial Developed & Developing Market Presence High Value Added Vertical Market Solutions Recurring Revenue Model CapEx Light Vs. Resi Model Global Footprint...

Open the catalog to page 6

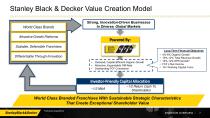

Stanley Black & Decker Value Creation Model World Class Brands Strong, Innovation-Driven Businesses In Diverse, Global Markets Attractive Growth Platforms Scalable, Defensible Franchises Long Term Financial Objectives Differentiable Through Innovation • Outsized, Capital-Efficient Organic Growth • Attractive, Expandable OM Rate • Outstanding FCF Conversion 4%-6% Organic Growth 10%-12% Total Revenue Growth 10%-12% EPS Growth* FCF ≥ Net Income 10+ Working Capital Turns Investor-Friendly Capital Allocation ~1/2 M&A ~1/2 Return Cash To Shareholders World Class Branded Franchises With...

Open the catalog to page 7

Expanding Geographic Reach Over Half Of Our Revenues Generated In The U.S. Stanley Black & Decker Tools & Storage Emerging Markets Emerging Markets -16% Of 2015 Revenue | Goal Of 20%+ Global Emerging Markets Represent A Significant Long-Term Opportunity For Organic Growth INVESTOR OVERVIEW

Open the catalog to page 8

Global Brand Power A Powerful Portfolio Of Well Managed Brands FASTENING INNOVATIONS SONITROL' ■■OTA'S VFRIFIFH Fl FCTRflMH SFHIJRITY ■ ■

Open the catalog to page 9

Global Brand Support Brand Impressions Website Visits Website Visits One of World's Most Popular Sports Team with 330M Global Fans. Most Popular Sport In China PROFESSIONAL BULL One Of The Fastest Growing Sports with 44M+ Fans, Most Are Not MLB STANLEY Awareness 18 Primary Race Events With Top Tier Team And Drivers In Front Of 80M Brand Loyal Fans. World's Premier Motorcycle Racing Series reaching 130M Fans Per Race Impressions From Social Media Sites MAJOR LEAGUE BASEBALL More Attendance Than NBA, NHL & NFL Combined. 130M TV Viewers With The Wounded Warrior Project,

Open the catalog to page 10

Revenue & EPS: Historical & Projected Performance Created World Class Global Franchises. 2015 Five Year CAGR 2015 Five Year CAGR .And Achieved Strong Top-Line & EPS Growth Track Record Reflects Continuing Operations Only *Excludes M&A Charges & Payments **lncludes $0.25 Of P&L Restructuring Charges Per Share INVESTOR OVERVIEW

Open the catalog to page 11

Free Cash Flow: Historical & Projected Performance Free Cash Flow Potential Emerging... 2015 Five Year CAGR Free Cash Flow($M) As M&A Synergy Related Payments Wind Down INVESTOR OVERVIEW

Open the catalog to page 12

Stock Price Performance Vs. S&P 500 SWK Has Outperformed The Market Over The Near & Long-Term. Plus, Strong Dividend Growth Has Enhanced Total Return INVESTOR OVERVIEW

Open the catalog to page 13

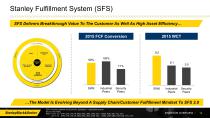

Stanley Fulfillment System (SFS) SFS Delivers Breakthrough Value To The Customer As Well As High Asset Efficiency… 2015 FCF Conversion Industrial Peers Security Peers Industrial Peers Security Peers …The Model Is Evolving Beyond A Supply Chain/Customer Fulfillment Mindset To SFS 2.0 FCF Conversion Defined As (Cash from Operations – CapEx)/Net Income Source: Bloomberg Peers: FCFC: Ind.- DHR, ETN, ITW, IR, MAS, NWL, SNA, SHW Sec. - ASSA, HON, SIE, TYC, UTX WCT: Ind. - DHR, ETN, ITW, IR, MAS, NWL, SNA, SHW Sec. – ASSA, CKP, DBD, HON, SIE, TYC, UTX INVESTOR OVERVIE

Open the catalog to page 14

SFS 2.0: Taking SFS To The Next Level Five Focused Initiatives Leveraging Success Of Original SFS. .Provide The Foundation For Continued Differentiated Performance

Open the catalog to page 15

SFS 2.0: Our Evolving Operating System Breakthrough Innovation Functional Transformation • Go Beyond Incremental Innovation • Form Dedicated Breakthrough Teams Across Company • Establish Breakthrough Innovation Culture Market Moving Growth Ideas >$100M • “Clean Sheet” Zero Based Approach • Completely Re-Think & Re-Tool Key Functions Fund Other SFS 2.0 Initiatives & Expand OM% Digital Excellence Drive Cost Effectiveness • Harness And Apply The Disruptive Power Of Digital Pervasively Commercial Excellence • Establish Continuous Process Improvements Across All Customer Facing Activities Boost...

Open the catalog to page 16All Stanley Tools catalogs and technical brochures

-

Investor Overview

13 Pages

-

SWK

156 Pages

-

Storage

20 Pages

-

Hammers

12 Pages

-

Saws

16 Pages

-

Measuring Tools

10 Pages

-

2011 Hand Tools Catalog

212 Pages