カタログの抜粋

ABB Division Fact Sheets

カタログの1ページ目を開く

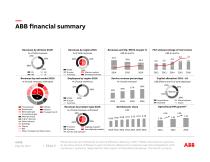

Revenues by division 20161 % of total revenues 19% 30% Revenues by end market 2016 % of total revenues, estimated Transmission Distribution Renewable gen. Conventional gen. Mining & metal O & G, Chemical Other Industry Buildings Marine Rail Other Transport & Infrastructure Utilities Industry Transport & Infr. Revenues by region 2016 % of total revenues AMEA Europe Americas Mature markets Emerging markets Employees by region 2016 % of total workforce Revenues and Op. EBITA margin % US$ bn and % 41.8 Capital allocation 2012 -16 US$ billions and % of total deployed 23% Dividend ^B Capex...

カタログの2ページ目を開く

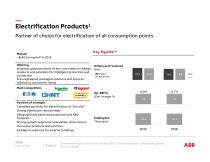

Offering Broadest global portfolio of low- and medium-voltage products and solutions for intelligent protection and connection Pre-engineered, packaged solutions and services tailored to customers’ needs Orders and revenues $ bn h Orders ™ Revenues Main competitors Position of strength Complete portfolio for electrification of “the site” Strong distributor relationships Geographically balanced production and R&D footprint Employees Strong growth segments renewables, data centers Thousand Innovative products and solutions Intelligent solutions for smarter buildings 1New divisional...

カタログの3ページ目を開く

Electrification Products1 Business breakdown and key end-market growth trends Channels2 Distribution Renewable gen. Mining & Metal O&G, Chemical Other Industry Buildings Other Transport & Infrastructure Digitalization: Connectivity and communication, digital models and configurators Service / software: Condition monitoring and diagnostics, cloud connection and cyber security, collect, provide and process data Distributors Internal Utilities EPC OEM Panel builders 36 Utilities Industry Transport & Infr. Buildings: Up globally, shift to smart buildings Industry: Solid growth from...

カタログの4ページ目を開く

Partner of choice for electrification of all consumption points Installation Building solutions u) O) c c <D LV/MV switchgear Distribution boards Circuit breakers Solar inverters, UPS MV grid automation Motor control centers Intelligent breakers Enclosures DIN-rail products Wire and cable mgmt. EV charging Wiring accessories Intelligent building / smart home products I Slide 5 1All comments pertain to the new divisional structure as of January 2017

カタログの5ページ目を開く

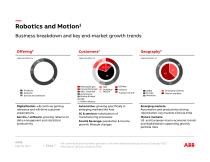

Robotics and Motion1 Partner of choice for robotics and intelligent motion solutions Key figures1,4 Offering Robotics and intelligent motion solutions Orders Revenues Main competitors Op. EBITA $ bn, margin % Employees Thousand Position of strength Technology leader in fast-growing robotics market Broadest robotics portfolio and large installed base Largest motion player with unmatched global reach At the cutting edge of power electronics and quality, renewables, and electric transportation divisional structure as of January 2017; 2Unconsolidated; 3Comparable growth; estimate

カタログの6ページ目を開く

Robotics and Motion1 Business breakdown and key end-market growth trends Offering2 72 37 Renewable gen. Conventional gen. O&G, Chemical Automotive Mining & Metal F&B Other Industry Products Systems Service and software Digitalization: will continue gaining relevance and will drive customer expectations Service / software: growing reliance on data management and statistical productivity Rail Buildings Marine Utilities Industry Transport & Infr. Automotive: growing specifically in emerging markets like Asia 3C & semicon: robotization of manufacturing processes Food & Beverage: population &...

カタログの7ページ目を開く

Motors & Generators Industrial robots, software and loTSP connected services u\ .£ Robotic applications and systems for diverse industries <4-O LV AC drives up to 5600 kW MV drives to 100 MW Wind converters Digital services and software tools Propulsion converters LV motors to 1’200 kW HV motors to 80 MW Power generators to 80 MW Mechanical power transmission SIEMENS SIEMENS SEW EURODRIVE TECO I Slide 8 1AH comments pertain to the new divisional structure as of January 2017

カタログの8ページ目を開く

Key figures1’4 Offering Control systems, software, measurement & analytics Industry-specific power & automation solutions, products (e.g. electric ship propulsion) and services Orders and revenues $ bn h Orders ™ Revenues Main competitors YOKDGAWA Schneider Electric Position of strength Integrated control product, system and service offering Advanced process control & optimization software and know-how Emp|oyees Integrated power and automation solutions Thousand Largest installed base, advanced services Deep domain and process expertise I Slide 9 1New divisional structure as of...

カタログの9ページ目を開く

Industrial Automation1 Business breakdown and key end-market growth trends Offering2 23 Utilities Conventional generation Industry O&G, Chemical Transport & Infr. Mining & Metals Other Industry Marine Other Transport & Infrastructure Products Systems Service and software Digitalization: growth opportunity building on largest installed base in power generation and process industry Services and software: supporting customers remotely with advanced services and optimization Chemicals: positive fundamentals F&B, pharma & discrete industries: population growth, increasing disposable income...

カタログの10ページ目を開く

Partner of choice for industrial automation Industry-specific solutions & services Control systems & Measurement & software analytics Integrated electrification & automation solutions 01 .£ Systems and advanced services Process industries #1-5 Marine #1 Process and discrete control (DCS, PLC) Adv. process control & manufacturing execution systems Pressure, temperature, flow, level, force measurement Analyzers Electric propulsion systems for ships Large turbochargers >500kW DCS #1; PLC top 10 Measurement & Electric marine propulsion #1 APC/MES software #1/2 analytics top...

カタログの11ページ目を開く

Key figures1’4 Offering Broadest offering of products systems, services and software for power transmission and distribution Orders and revenues $ bn h Orders ™ Revenues Main competitors Op. EBITA $ bn, margin % Position of strength Market and technology leader Unrivalled application know-how Truly global player with largest installed base Leading software and automation solutions Industry leading margins Employees Thousand I Slide 12 *New divisional structure as of January 2017; Consolidated (unconsolidated ~$140 bn market); Comparable growth; 4Best estimate

カタログの12ページ目を開くABB Smart Powerのすべてのカタログと技術パンフレット

-

Bus couplers

3 ページ

-

SlimLine XR

52 ページ

-

SACE Emax 2

277 ページ

-

TruOne

68 ページ

-

Switch-disconnectors

192 ページ

-

OFAM/ OFAA

2 ページ

-

SACE Tmax XT

8 ページ

-

YO-YC Test unit

5 ページ

-

Case study. PRAMAC

4 ページ

-

Installation contactors

32 ページ

-

Blackburn Storm Safe

4 ページ

-

Twist Tail Brochure

2 ページ

-

Pacific Intertie

2 ページ

-

ABB HVDC Classic

24 ページ

-

Switches for PV application

108 ページ

-

V400

2 ページ

-

V16

2 ページ

-

P42E

2 ページ

-

Nightstar

2 ページ

-

ROYCE THOMPSON

4 ページ

-

Guideway & Serenga 2

28 ページ

-

Analog signal converters

28 ページ

-

Switch fuses OS and OSM

116 ページ

-

EasyLine XLP

31 ページ